These accounts are designed to cater to both novice and experienced traders by offering a balance of simplicity and depth in trading options. With a low minimum deposit requirement, Exness Standard Accounts make the forex markets accessible to a wider audience, providing an opportunity for traders to engage with a variety of currency pairs, metals, and other instruments. The flexibility in leverage, competitive spreads, and the absence of hidden commissions underscore the account’s appeal, making it an attractive choice for those seeking transparency and cost-efficiency in their trading operations.

Moreover, Exness Standard Accounts are known for their exceptional support and educational resources, aiming to empower traders with the knowledge and tools needed to navigate the markets successfully. The platform offers advanced charting tools, real-time financial news, and analytics to help traders make informed decisions.

Additionally, the provision of a demo account enables users to practice strategies and get acquainted with the platform’s features without any financial risk. Coupled with 24/7 customer support, Exness ensures that Standard Account holders receive the guidance and assistance they need, anytime and anywhere, making it a comprehensive solution for those looking to dive into forex trading with confidence.

Types of Exness Standard Accounts

Exness offers a variety of Standard Accounts tailored to meet the needs of different traders, from beginners to more experienced individuals. Each account type under the Standard category is designed to provide specific features and benefits, allowing traders to select the one that best suits their trading style and objectives. Here’s an overview of the types of Standard Accounts typically available at Exness:

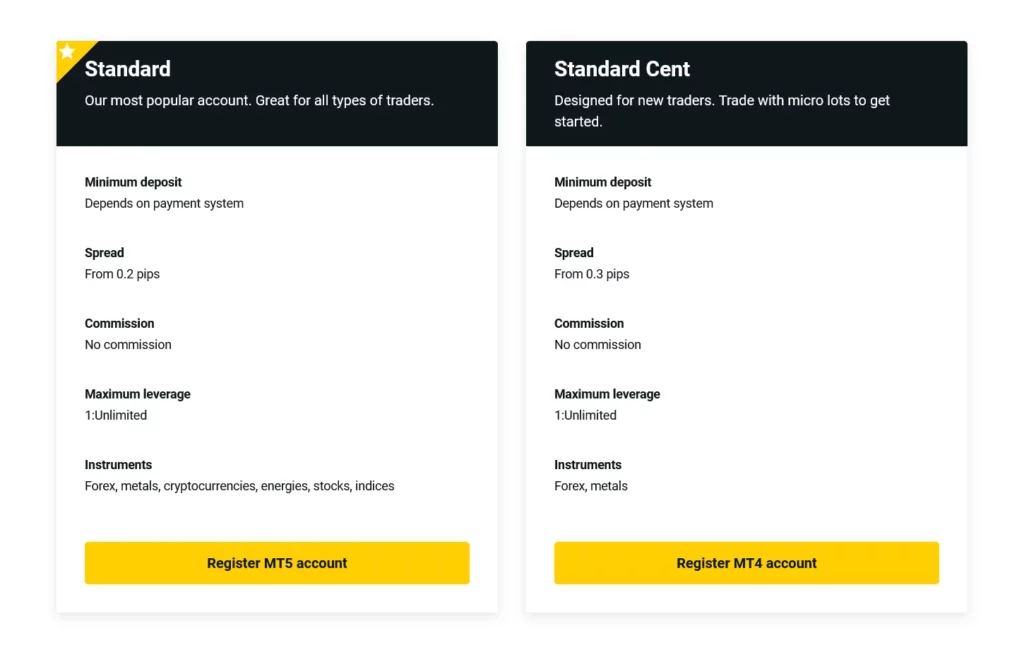

- Standard Account: This is the most accessible account type and is ideal for beginners and those who prefer a straightforward trading experience. It features a minimal initial deposit, no commission on trades, and competitive spreads. The Standard Account is versatile, supporting a wide range of trading instruments including forex, metals, cryptocurrencies, energies, and indices.

- Standard Cent Account: Tailored for new traders and those looking to trade with lower volumes, the Standard Cent Account denominates your balance in cents. This allows traders to experience the market with reduced risk, making it an excellent choice for testing strategies or getting accustomed to live trading without a significant financial commitment. The features are similar to the Standard Account but adjusted for micro trading.

| Account Type | Ideal For | Spreads | Commission | Minimum Deposit | Features |

| Standard Account | Beginners and casual traders | Competitive | No | Low | Wide range of instruments |

| Standard Cent Account | New traders, micro trading | Competitive | No | Very low | Denominated in cents for lower risk |

Exness Standard Cent Account

The Exness Standard Cent Account is an account type designed primarily for new traders or those looking to test trading strategies with minimal financial risk. It’s an excellent choice for gaining experience in the forex market without the pressure of managing a large balance.

Exness Standard Cent Account are designed to provide a comprehensive overview of what makes this account type particularly appealing to new traders and those looking to test strategies with minimal risk:

| Feature/Benefit | Description |

| Currency Denomination | Account balance, profit, and loss are denominated in cents. |

| Financial Risk | Significantly reduced, ideal for new strategies and learning. |

| Minimum Deposit | Very low, making it highly accessible for beginners. |

| Leverage | Flexible options to suit risk tolerance and strategy. |

| Trading Instruments | Access to a wide range of instruments including forex, metals, and cryptocurrencies. |

| Trading Platforms | Compatible with MetaTrader 4 and MetaTrader 5 platforms. |

| Ideal Learning Environment | Perfect for beginners to experience real-money trading without substantial financial exposure. |

| Strategy Testing | Allows experienced traders to test new strategies or EAs in a live market environment. |

| Transition to Larger Scales | Facilitates a smooth transition to standard accounts for larger scale trading. |

Exness Standard Account Setup for South African Traders

Here’s a step-by-step guide tailored for South African traders looking to open a Standard Account with Exness:

Step 1: Visit the Exness Website

- Navigate to the official Exness website. It’s essential to use the correct website address to ensure you’re dealing with the legitimate platform and to protect your personal information.

Step 2: Sign Up

- Click on the “Open an Account” or similar button found on the homepage.

- Provide the required information, which typically includes your email address and a password. South African traders may also be asked to input their mobile number for additional account security and verification purposes.

Step 3: Email and Mobile Verification

- Verify your email address by clicking on the link sent to your inbox. This step confirms your email as a valid contact point.

- Verify your mobile number if prompted, by entering a verification code sent via SMS. This extra layer of verification enhances the security of your account.

Step 4: Complete Your Profile

- Fill out your profile with additional personal details. This will likely include your full name, date of birth, address, and possibly a tax identification number. Be prepared to provide accurate information that matches your official documents.

Step 5: KYC (Know Your Customer) Process

- Upload identification documents. South African residents will need to provide a clear copy of their government-issued ID (such as an ID card or passport) and a proof of residence document (like a utility bill or bank statement) that is no older than three months.

- Complete any additional KYC requirements specific to South Africa, which might include disclosing your financial status or investment experience. These regulations are designed to protect both the trader and broker by ensuring appropriate trading conditions are met.

Step 6: Account Selection

- Choose the Standard Account from the available options. You may be prompted to select your preferred trading platform (such as MetaTrader 4 or MetaTrader 5) at this stage.

Step 7: Deposit Funds

- Make your first deposit. Look into the deposit methods available for South African traders, which often include bank wire transfers, credit/debit cards, and e-wallets. Be aware of the minimum deposit requirement, which is typically very accessible.

Step 8: Download and Install Trading Platform

- Access the trading platform. Download and install your chosen platform, or opt for the WebTerminal for browser-based trading. Ensure your device meets any specified requirements for a smooth trading experience.

Step 9: Start Trading

- Begin your trading journey. With your account set up and funded, you’re ready to start trading. Use the tools and resources provided by Exness to assist in making informed trading decisions.

Fees and Commissions of Exness Standard Account

Exness is known for its competitive fee structure, which is designed to accommodate traders of all levels, particularly those using Standard Accounts. The broker’s transparent approach to fees and commissions makes it easier for traders to understand their trading costs, which can contribute to more effective trading strategies. Here’s an overview of the fees and commissions associated with Exness Standard Accounts:

Spread

- Standard Accounts typically operate on a spread-based model. This means traders pay through the bid-ask spread instead of a fixed commission on trades. The spreads are competitive and vary depending on the market conditions and the currency pairs being traded. For major currency pairs, spreads can be very tight, offering cost-effective trading opportunities.

No Commission

- One of the appealing features of the Exness Standard Account is that there are no trading commissions. This applies to the vast majority of trades, making it easier for traders to manage their costs and maximize their potential profits.

Swap Fees

- Swaps, or overnight financing charges, are applied to positions that are held open overnight. The rates vary according to the type of instrument and the direction of the trade (long or short). Exness provides detailed information on swap rates directly in the trading platform, allowing traders to consider these costs when planning their trading strategies.

Deposit and Withdrawal Fees

- Exness does not charge any fees for deposits or withdrawals on their side. However, traders should be aware that some payment systems may impose their own fees or limits on transactions.

Inactivity Fees

- As of the latest information available, Exness does not charge inactivity fees, even if an account remains dormant for an extended period. This is beneficial for traders who may not trade regularly but wish to keep their accounts open.

Other Fees

- Exness prides itself on transparency, so any additional fees, such as those that might rarely apply to specific financial instruments or situations, are clearly communicated in advance. It’s always a good idea for traders to review the most current fee information on the Exness website or directly within their trading platform to ensure they have the latest details.

Platform and Tools of Standard Account

Exness provides a comprehensive suite of platforms and tools for traders using Standard Accounts, designed to enhance the trading experience by offering robust analytics, seamless execution, and user-friendly interfaces. These resources cater to both novice and experienced traders, ensuring that everyone can trade efficiently and effectively. Here’s a rundown of the primary platforms and tools you can expect:

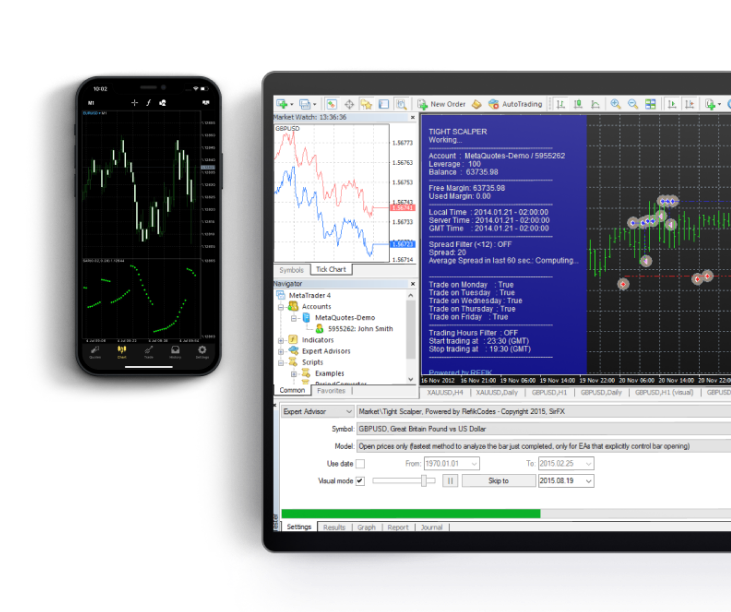

MetaTrader 4 (MT4)

- Popularity: One of the most popular trading platforms in the world, known for its reliability, ease of use, and comprehensive analytical tools.

- Features: Includes interactive charts, a wide range of technical indicators, and automated trading capabilities through Expert Advisors (EAs). MT4 is particularly favored for its customizability and the vast online community that supports it.

MetaTrader 5 (MT5)

- Upgrade from MT4: While retaining the core functionalities of MT4, MT5 offers additional features such as more technical indicators, timeframes, graphical objects, and an economic calendar integrated directly into the platform.

- Versatility: Supports trading of stocks and futures in addition to forex, making it a versatile platform for traders looking to diversify their portfolios.

Exness Trader App

- Mobility: Designed for traders on the go, the Exness Trader App allows for trading directly from your smartphone. It offers a simplified trading experience without sacrificing analytical depth.

- Convenience: Features include mobile account management, instant deposits and withdrawals, and live chat support.

Web Terminal

- Accessibility: For traders who prefer not to download or install software, the WebTerminal provides a convenient, web-based trading platform accessible from any browser.

- Functionality: Offers real-time quotes, one-click trading, and a range of analytical tools, making it a practical option for both quick trades and in-depth analysis.

Educational Resources and Tools

- Learning Materials: Exness provides a wealth of educational content, including webinars, tutorials, and articles to help traders develop their skills.

- Analytical Tools: Traders have access to market news, economic calendars, and analysis to inform their trading decisions.

Support and Security

- Customer Support: 24/7 support is available, ensuring that traders can get assistance whenever they need it.

- Security Measures: Exness takes security seriously, employing advanced technological measures to protect traders’ data and financial assets.

Tips for Trading in South Africa with Exness Standard Accounts

Trading in South Africa with Exness Standard Accounts can be a rewarding experience, provided traders are well-prepared and informed about the local market conditions as well as international trading standards. Here are some tailored tips to help you make the most of your trading experience with Exness in South Africa:

1. Understand Local Regulations

- Be aware of the regulations set by the Financial Sector Conduct Authority (FSCA) of South Africa. While Exness is a global broker, knowing local regulations can help you navigate forex trading within the legal framework of South Africa.

2. Start with a Demo Account

- Utilize Exness’s demo account to familiarize yourself with the trading platform and test your strategies without any risk. This step is crucial for understanding market dynamics and the functionality of trading tools.

3. Leverage Educational Resources

- Exness offers a wide range of educational materials, including webinars, tutorials, and articles. Take advantage of these resources to enhance your trading knowledge, especially about aspects that are crucial for trading in the South African market.

4. Keep an Eye on the ZAR

- As a South African trader, you might have a particular interest in pairs involving the South African Rand (ZAR). Monitor local economic indicators, political events, and international factors that might affect the ZAR’s value.

5. Employ Risk Management

- Use risk management tools effectively. Setting stop-loss and take-profit orders can help manage your risks and protect your investments, especially in the volatile forex market.

6. Diversify Your Portfolio

- While focusing on the ZAR might be tempting, diversifying your portfolio can help spread risk. Exness’s Standard Accounts offer access to a variety of instruments, including forex, metals, cryptocurrencies, and more.

7. Monitor Global Events

- International events can significantly impact the forex market. Keep an eye on global economic news, geopolitical events, and financial announcements that could influence market volatility and, consequently, your trading strategies.

8. Plan Your Trading Schedule

- Forex markets operate 24/5, offering different trading opportunities across various time zones. Plan your trading schedule around the most active trading hours for the currency pairs you are interested in, especially those involving the ZAR.

Conclusion

The Exness Standard account in South Africa presents traders with a versatile and user-friendly platform to engage in the global financial markets. Offering competitive spreads and straightforward trading conditions, it serves as an accessible option for both novice and seasoned traders alike. With features such as instant execution and leverage options, traders have the flexibility to execute their trading strategies efficiently across a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies.

Moreover, Exness typically prioritizes customer support, offering assistance via various channels such as live chat, email, and phone support to address traders’ inquiries and concerns promptly. Additionally, traders may benefit from educational resources such as tutorials, webinars, and market analysis, enhancing their trading knowledge and skills.

With mobile trading capabilities, traders can access their accounts and trade on-the-go, utilizing mobile apps compatible with iOS and Android devices. Overall, the Exness Standard account in South Africa stands as a reliable and accessible option for traders seeking to participate in the financial markets, supported by regulation, competitive trading conditions, robust customer support, and educational resources.

What is an Exness Standard Account?

An Exness Standard Account is a type of forex trading account offered by Exness, designed for both beginner and experienced traders. It features competitive spreads, no trading commissions, and access to a wide range of trading instruments, including forex, metals, and cryptocurrencies. It’s known for its accessibility, offering a low minimum deposit and flexible leverage options.