Exness provides a secure and regulated trading environment, with adherence to international standards and practices. The professional accounts offer negative balance protection, ensuring traders do not lose more than their account balance, which is a critical safety net especially when employing high leverage. The availability of demo accounts also allows traders to practice and refine their strategies in a risk-free environment before transitioning to live trading. For traders seeking to optimize their trading experience with tailored features and a robust trading environment, Exness Professional Accounts offer a comprehensive and sophisticated solution.

Types of Exness Professional Accounts

Exness offers various types of Professional Accounts, each designed to cater to the specific needs and strategies of advanced traders. The main types of Professional Accounts at Exness include:

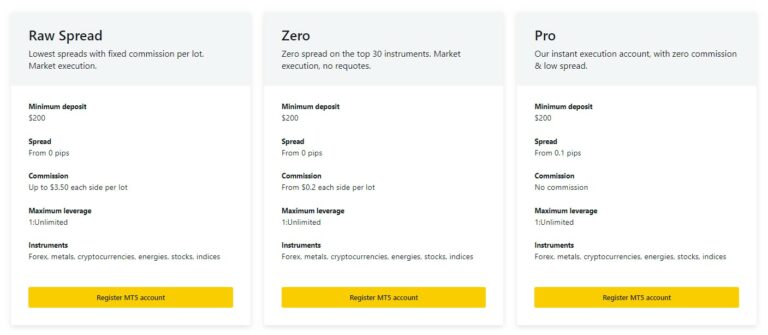

Raw Spread Account:

This account type is ideal for traders who prefer trading with the raw spreads received directly from liquidity providers, without any additional markup. It typically offers the lowest spreads but may come with a commission on trades. It’s suitable for scalpers and high-volume traders who seek the best possible spreads.

Zero Account:

The Zero Account is designed to offer zero or near-zero spreads on major currency pairs for most of the trading day. While it may include a commission, this account is particularly appealing for traders who employ strategies that benefit from minimal spreads, such as high-frequency trading or scalping.

Pro Account:

The Pro Account is tailored for professional traders who prefer all-inclusive spreads without separate commission charges. It offers a balance between competitive spreads and no commission costs, making it suitable for traders using more traditional trading strategies that might not necessitate ultra-tight spreads.

Each of these account types is structured to provide specific trading conditions that can enhance the trading strategies employed by professional traders. By offering different types of professional accounts, Exness aims to cater to a broad spectrum of trading styles and preferences, ensuring that advanced traders can find an account that aligns with their strategy and trading goals. For more detailed information and to determine which account best suits your trading needs, it’s recommended to visit the Exness website or consult with their customer support.

- Types of Exness Professional Accounts

- Raw Spread Account

- Zero Account

- Pro Account

- How to Apply for an Exness Pro Account

- What Type of Account to Choose Correctly

- Criteria Specific to South African Exness Traders

- Features and Advantages of Exness Pro Accounts

- Conclusion

- FAQs about Exness Professional Accounts

Raw Spread Account

The Exness Raw Spread Account is specifically designed for traders who prefer trading with the lowest possible spreads. This account type typically appeals to scalpers and day traders who benefit from low spread costs. Below is a detailed breakdown of the features you can expect with an Exness Raw Spread Account:

| Feature | Description |

| Spreads | As low as 0.0 pips on major currency pairs, offering direct pricing from liquidity providers. |

| Commissions | A commission is charged per trade, which is common for raw spread accounts to compensate for the low spreads. |

| Leverage | Up to 1:2000, providing significant trading flexibility and the potential for increased returns. |

| Minimum Deposit | The minimum deposit might vary, but professional accounts typically require higher initial funding compared to standard accounts. |

| Trading Platforms | Access to MetaTrader 4 and MetaTrader 5, offering robust trading tools and functionalities. |

| Instruments | A wide range of trading instruments including forex, metals, cryptocurrencies, energies, and indices. |

| Execution Type | Market execution, allowing for rapid order execution without requotes. |

| Negative Balance Protection | Available to prevent clients from losing more than their account balance. |

| Account Currency | Options including major currencies and possibly ZAR for South African traders. |

| Educational Resources | Access to advanced educational materials and market analysis. |

This account is well-suited for experienced traders who can leverage the benefits of tight spreads and are comfortable paying commissions for their trades. Traders should always consider their trading style and strategy to determine if a raw spread account aligns with their trading goals. For the most accurate and specific details, visiting Exness’s official website or contacting their customer support is recommended, especially to get the latest information pertinent to South African traders.

Demo accounts are widely used across different financial markets, including forex, stocks, commodities, and cryptocurrencies, providing a valuable learning experience for traders at all levels.

Zero Account

The Exness Zero Account is tailored for traders looking for ultra-low spreads on major currency pairs, often reaching as low as 0.0 pips. This account type typically includes a commission on trades to compensate for the reduced spread. Below is a summary table highlighting the key features of the Exness Zero Account:

| Feature | Description |

| Spreads | Zero or near-zero on major forex pairs during most of the trading day. |

| Commissions | A specific commission per trade is applied, reflecting the account’s ultra-low spread offering. |

| Leverage | Offers high leverage, up to 1:2000, giving traders the flexibility to increase their market exposure. |

| Minimum Deposit | Requires a higher minimum deposit compared to standard accounts, aligning with its professional nature. |

| Trading Platforms | Availability of MetaTrader 4 and MetaTrader 5, equipped with features for advanced trading. |

| Instruments | Access to a broad range of instruments, including forex, commodities, indices, and more. |

| Execution Type | Market execution ensures rapid trade execution without re-quotes. |

| Negative Balance Protection | Included to protect traders from going below zero in their account balance. |

| Account Currency | Multiple currency options, potentially including ZAR for South African clients. |

| Educational Resources | Provides advanced trading insights and educational materials suitable for professional traders. |

The Zero Account is particularly beneficial for traders who execute large volumes and require tight spreads to optimize their trading strategies. It’s best suited for experienced traders who can take advantage of the near-zero spreads while managing the associated commission costs. For detailed information and the latest features specific to South African traders, it’s advisable to consult Exness’s official resources or reach out to their customer support.

Pro Account

The Exness Pro Account is designed for professional traders who prefer an all-inclusive trading environment with no commissions on trades. This account type offers competitive spreads and access to a comprehensive range of trading instruments. Below is a detailed table outlining the primary features of the Exness Pro Account:

| Feature | Description |

| Spreads | Competitive spreads starting from low values, designed to cater to professional traders. |

| Commissions | No commission is charged on trades, providing a clear cost structure for trading activities. |

| Leverage | High leverage options available, up to 1:2000, allowing significant market exposure. |

| Minimum Deposit | Generally requires a higher minimum deposit than standard accounts, reflecting its professional status. |

| Trading Platforms | Supports MetaTrader 4 and MetaTrader 5, offering advanced tools and analytics for sophisticated trading strategies. |

| Instruments | Includes a wide array of trading instruments across forex, commodities, indices, and more. |

| Execution Type | Offers market execution, facilitating quick and efficient order placements without requotes. |

| Negative Balance Protection | Provides protection to ensure traders do not lose more than their account balance. |

| Account Currency | Offers various currency options, potentially including ZAR for South African traders. |

| Educational Resources | Access to in-depth educational materials and market insights to support informed trading decisions. |

The Pro Account is ideal for traders who need a straightforward cost structure with the added benefit of no commissions. It suits those who trade significant volumes and can leverage the competitive spreads to enhance their trading profitability. For the most current and detailed information, particularly tailored for South African traders, visiting Exness’s website or contacting their customer support is recommended.

How to Apply for an Exness Professional Account in South Africa

To apply for an Exness Professional Account in South Africa, you’ll need to follow a series of steps that align with Exness’s application procedures and comply with local regulatory requirements. Here’s a general outline of the process:

- Visit the Exness Website: Start by going to the Exness website. It’s crucial to ensure you’re visiting the official site to protect your personal information.

- Choose the Account Type: Select the Professional Account option. You’ll likely have choices like the Raw Spread, Zero, or Pro accounts. Understand the features and benefits of each to decide which best suits your trading style and needs.

- Registration: Complete the registration process by providing your personal details. This typically includes your name, email address, contact information, and sometimes financial information or trading experience.

- Verification: Verify your identity and residence by uploading the required documents. This usually includes a government-issued ID and a utility bill or bank statement for address verification, adhering to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Compliance Checks: Ensure you comply with all regulatory requirements, including those set by the FSCA in South Africa. This might involve answering questions to assess your trading experience and financial knowledge.

- Deposit Funds: Once your account is set up and verified, you’ll need to deposit the minimum required amount for the Professional Account you’ve chosen. Payment methods and minimum deposit amounts can vary, so check the specific requirements for South African traders.

- Start Trading: With your account funded, you can begin trading. It’s advisable to familiarize yourself with the platform and tools available, perhaps starting with a demo account if you’re new to Exness or wish to test strategies without financial risk.

- Ongoing Compliance and Risk Management: Regularly review your account to ensure ongoing compliance with trading regulations and manage your risk appropriately, especially considering the high leverage and complex instruments available with professional accounts.

Always refer to the Exness website or contact their customer support for the most current and detailed information specific to South African regulations and the application process for a Professional Account.

What Type of Professional Account to Choose Correctly

Choosing the right type of Professional Account at Exness depends on your trading style, strategy, experience level, and specific needs. Here’s a guide to help you decide which Professional Account might be the best fit for you:

- Raw Spread Account:

- Ideal for: Traders who prefer paying commissions over spreads and want direct access to market prices.

- Best suited for: Scalpers and high-frequency traders who benefit from the lowest possible spread.

- Key feature: Offers spreads from 0.0 pips with a commission on trades.

- Pro Account:

- Ideal for: Traders looking for zero or near-zero spreads on major currency pairs.

- Best suited for: Day traders and those using automated trading systems who can take advantage of tight spreads.

- Key feature: Provides ultra-low spreads with a commission, particularly beneficial during peak trading hours.

- Zero Account:

- Ideal for: Experienced traders who prefer all-inclusive pricing without separate commission charges.

- Best suited for: Traders executing larger trades less frequently, who can benefit from the slightly wider but all-inclusive spreads.

- Key feature: No commission fees, offering a balance between competitive spreads and simplicity in trading costs.

When choosing your account, consider the following factors:

- Trading Volume: Higher volumes can often offset commission costs in Raw Spread and Zero accounts.

- Trading Frequency: Frequent traders might prefer Raw Spread or Zero accounts for the lower spread costs, while less frequent traders might find the Pro account more cost-effective.

- Strategy: If your strategy relies on tight spreads, Raw Spread or Zero accounts might be more suitable. If your strategy is more about the bigger picture and less sensitive to slight spread variations, a Pro account could be more beneficial.

- Cost Preference: Consider whether you prefer the transparency of paying commissions separately (Raw Spread or Zero) or if you’d rather have a single cost built into the spread (Pro).

Ultimately, the best way to decide is to align the account features with your trading strategy and preferences. It might also be beneficial to experiment with a demo account for each type to experience firsthand how the different cost structures and trading conditions affect your trades. For more detailed guidance, you can always reach out to Exness’s customer support or consult their website for additional information.

Criteria Specific to South African Exness Traders

For South African traders looking to open a Professional Account with Exness, there are specific criteria and features tailored to meet their regional needs and regulatory requirements:

- Regulatory Compliance: South African traders must ensure that their activities comply with the Financial Sector Conduct Authority (FSCA) regulations, which govern financial services in the region. Exness is regulated by the FSCA, providing a secure and regulated trading environment for South African traders.

- ZAR Base Currency Accounts: South African traders can benefit from opening accounts in ZAR, eliminating the need for currency conversion and reducing transaction costs. This feature simplifies financial management and aligns trading activities with local economic conditions.

- Local Payment Methods: Exness supports local deposit and withdrawal methods, facilitating convenient and cost-effective transactions for South African traders. This accessibility ensures that funds can be moved efficiently in and out of trading accounts with minimal delays.

- Economic and Market Insights: Given the unique economic landscape in South Africa, Exness provides market insights and analysis that cater to local and regional economic events, aiding traders in making informed decisions based on relevant data.

- Customer Support: Exness offers customer support tailored to South African traders, including services in local languages and understanding of local market conditions, which enhances the overall trading experience.

- Educational Resources: Recognizing the diverse needs of South African traders, Exness provides educational resources and training materials that are relevant to the South African market, helping traders at all levels to improve their trading skills and market understanding.

For South African traders, it’s crucial to choose a broker like Exness that not only complies with local regulations but also offers tailored services to meet their specific trading needs and preferences. Checking with Exness directly or visiting their website will provide the most current and detailed information specific to South African traders.

Features and Advantages of Exness Professional Accounts

Exness Professional Accounts are tailored for experienced traders, providing a host of features to enhance trading efficiency and effectiveness. Here’s a breakdown of the key advantages:

- Competitive Spreads and Commissions: Raw Spread and Zero accounts offer low spreads from 0.0 pips, while the Pro Account has no commissions, making it cost-effective for high-volume traders.

- High Leverage Options: Leverage up to 1:2000 allows for significant market positions, increasing potential returns. Traders should exercise caution due to the higher risk involved.

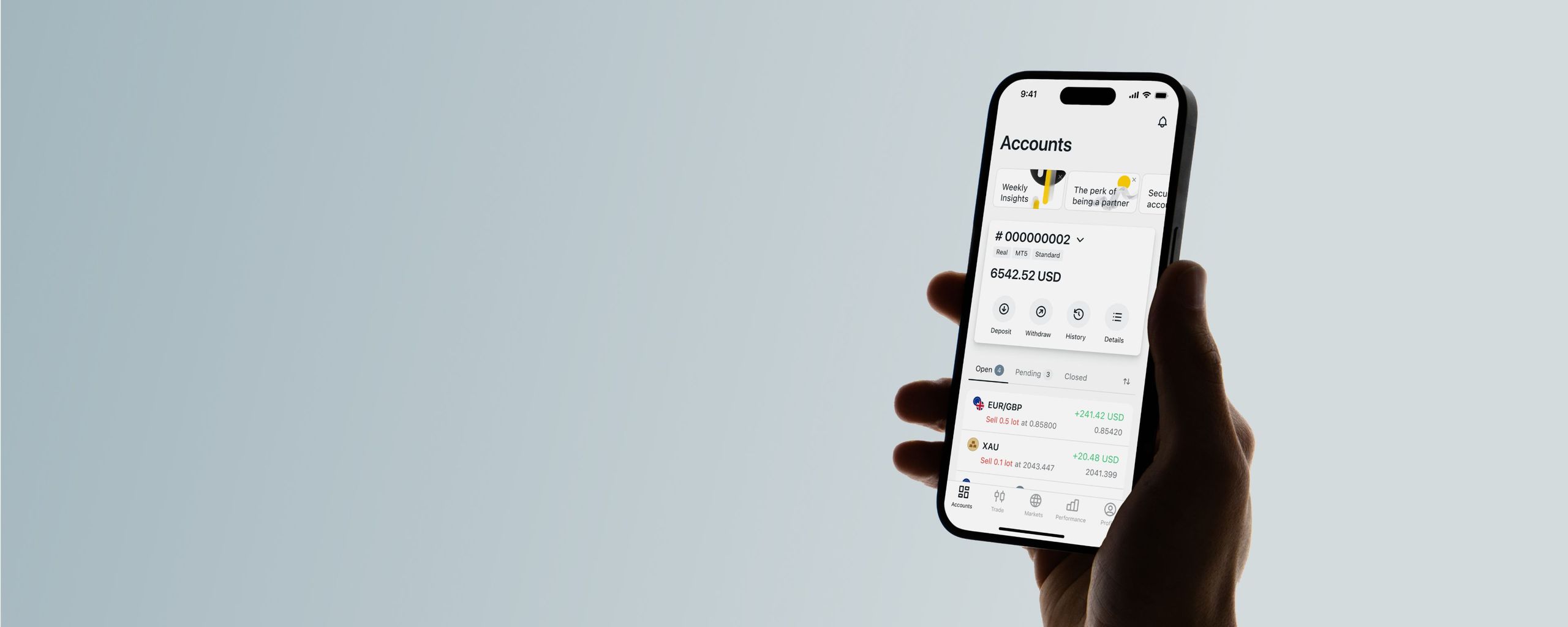

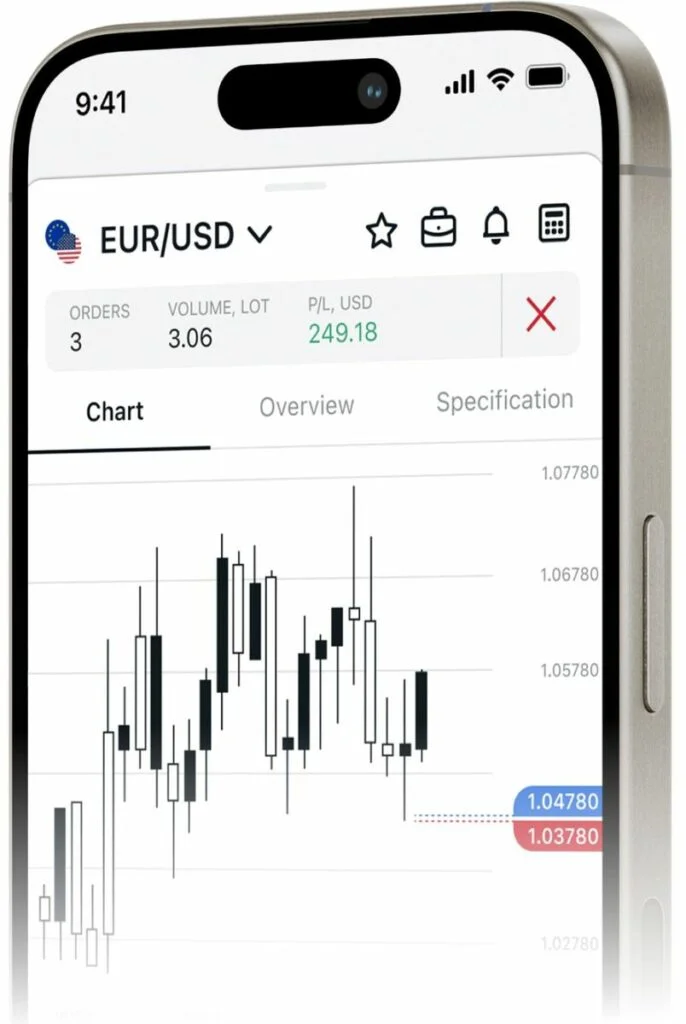

- Advanced Trading Platforms: Access to MetaTrader 4 and MetaTrader 5, robust platforms with a variety of tools, indicators, and expert advisors for diverse trading strategies.

- Wide Range of Trading Instruments: Trade forex pairs, metals, cryptocurrencies, energies, and indices to diversify portfolios and capitalize on market opportunities.

- Market Execution: Quick trade execution without requotes, vital for fast-paced strategies or volatile market conditions.

- Negative Balance Protection: Safeguards capital, ensuring traders don’t lose more than their account balance, even in turbulent markets.

- Dedicated Customer Support: Professional account holders receive priority support for efficient assistance whenever needed.

- Educational Resources and Market Analysis: Access advanced educational materials, market analysis, and insights to make informed trading decisions and refine strategies.

Conclusion

Exness offers Professional and Standard Accounts to meet traders’ diverse needs. Professional Accounts, like Raw Spread, Zero, and Pro, cater to advanced traders with lower spreads, higher leverage, and more trading instruments. These accounts suit experienced traders with sophisticated strategies.

Standard Accounts, ideal for beginners or casual traders, have higher spreads, no commissions, and an easy-to-use interface. They require lower minimum deposits, making them accessible to traders with varying experience and capital.

Choosing between Professional and Standard Accounts depends on your trading style, experience, and goals. Consider factors like preferred instruments, desired leverage, risk tolerance, and need for advanced features when selecting an account type.

What are the different types of Exness Professional Accounts?

Exness offers several types of Professional Accounts, including Raw Spread, Zero, and Pro Accounts. Each account type has distinct features tailored to different trading strategies and preferences.