Depositing funds into Exness accounts is straightforward, with the platform supporting various payment methods tailored for South African users, such as local bank transfers, credit/debit cards, and popular e-wallets. The flexibility of these options allows traders to choose the most convenient method for their needs. Exness is also known for its quick processing times, ensuring traders’ accounts are funded promptly for timely trading opportunities.

In terms of withdrawals, Exness maintains its commitment to efficiency and security. The withdrawal process mirrors the intuitive deposit process, providing multiple secure withdrawal methods. The platform’s strict security standards protect users’ financial information and the integrity of their funds. Traders are also informed transparently about potential fees or conversion rates, ensuring clarity and no surprises. Additionally, the availability of local customer support for South African traders adds an extra layer of assistance, ensuring timely guidance throughout the deposit and withdrawal processes.

Exness Deposit Methods

Exness offers a variety of deposit methods to accommodate the diverse needs of its global user base, including traders in South Africa. These methods are designed to provide convenience, speed, and security, allowing traders to fund their accounts efficiently and start trading. Here’s an overview of the typical deposit methods available at Exness:

Bank Transfers

- Local Bank Transfers: Traders can deposit funds directly from their local bank accounts. This method is generally preferred for its familiarity and the absence of additional transaction fees.

- International Bank Wire Transfers: This option is available for traders who wish to transfer funds from international banks. It might take a few business days for the funds to reflect in the trading account.

Credit and Debit Cards

- Visa/MasterCard: Traders can use their Visa or MasterCard credit or debit cards to make instant deposits. This method is widely used due to its convenience and the immediacy of fund availability in the trading account.

E-Wallets

- Skrill, Neteller, and Other E-Wallets: E-wallets offer a quick and easy way to deposit funds. Transactions are usually processed instantly, and traders can start trading without any significant delays.

Cryptocurrencies

- Bitcoin and Other Cryptocurrencies: Some traders prefer using cryptocurrencies like Bitcoin for deposits due to their enhanced privacy and instant processing times.

Mobile Payments

- Mobile Payment Systems: Depending on the region, mobile payment options like M-Pesa (popular in some African countries) can be a convenient way to deposit funds.

Specifics for South African Traders

- Traders in South Africa might have access to local payment methods that are tailored to their regional banking systems and preferences.

- The availability of ZAR as a base currency can facilitate easier and more cost-effective transactions for South African traders.

General Considerations

- Minimum and Maximum Limits: Deposit methods come with their minimum and maximum limits, which traders need to consider when funding their accounts.

- Processing Times: While many deposit methods offer instant processing, some, like bank transfers, may take longer.

- Security: Exness employs stringent security measures to protect financial transactions, ensuring that traders’ funds and financial information remain secure.

- Fees: Generally, Exness does not charge any deposit fees. However, it’s crucial for traders to check if their selected payment method incurs additional charges.

Before choosing a deposit method, traders should consider factors like convenience, processing time, and any potential fees. Exness provides detailed instructions and support for each deposit method, ensuring that traders can fund their accounts smoothly and securely.

Exness Withdrawal Methods

Exness provides various withdrawal methods to cater to the diverse preferences and needs of its users, ensuring a convenient, secure, and efficient process for retrieving funds. Here’s an overview of the typical withdrawal methods available at Exness, emphasizing the ease with which traders, including those in South Africa, can access their funds:

Bank Transfers

- Local Bank Transfers: Users can withdraw their funds directly to their local bank accounts, which is a preferred method for many due to its security and directness. However, processing times can vary based on the local banking procedures.

- International Bank Wire Transfers: This method allows traders to transfer their earnings to international bank accounts. While secure, it’s important to note that international wire transfers may take longer to process and could incur additional bank fees.

Credit and Debit Cards

- Visa/MasterCard: Withdrawals can be made directly to the trader’s Visa or MasterCard credit or debit card. This method is popular for its convenience and relatively fast processing times, although it’s essential to check if your specific card type is supported for withdrawals.

E-Wallets

- Skrill, Neteller, and More: E-wallets offer a rapid withdrawal method with typically instant or near-instant processing times once the withdrawal is approved. These platforms are known for their ease of use and fast access to funds.

Cryptocurrencies

- Bitcoin and Other Cryptocurrencies: Some traders opt for cryptocurrency withdrawals due to their speed and the privacy they offer. Withdrawal times can be very quick, although they depend on the network speed and transaction fees of the specific cryptocurrency.

Specifics for South African Traders

- South African traders might have access to localized withdrawal methods that align with their regional banking systems, offering them tailored solutions for accessing their funds.

- It’s beneficial for South African users to withdraw in their local currency (ZAR) to avoid additional conversion fees, provided that Exness supports ZAR transactions.

General Considerations

- Processing Times: While e-wallets and cryptocurrencies typically offer faster processing times, bank transfers and credit/debit card withdrawals might take longer, depending on various factors including the trader’s bank policies.

- Security: Exness employs advanced security measures to safeguard the withdrawal process, ensuring that users’ funds are protected at every step.

- Minimum and Maximum Limits: Different withdrawal methods have their specific minimum and maximum limit restrictions, which traders should review before initiating a withdrawal.

- Fees: Exness prides itself on transparency, ensuring that traders are aware of any potential withdrawal fees. While Exness may not charge withdrawal fees, it’s crucial to check if there are any third-party fees associated with the chosen withdrawal method.

Before proceeding with a withdrawal, traders are advised to ensure that their account verification is complete to avoid any delays. Exness typically processes withdrawal requests swiftly, reflecting its commitment to providing an efficient trading experience for its users globally, including those in South Africa.

Exness Local Bank Transfers in South Africa

Exness offers the option of local bank transfers for South African traders, which is a convenient and cost-effective method for both deposits and withdrawals. This method allows traders to transfer funds directly between their bank accounts and their Exness trading accounts, leveraging the local banking infrastructure for ease and efficiency. Here’s a closer look at how local bank transfers work for Exness users in South Africa:

Local Bank Transfers for Deposits

- Availability: Check if your local bank is supported by Exness for direct bank transfers. Most major South African banks are likely to be on the list of supported institutions.

- Initiating a Deposit: To make a deposit, log into your Exness Personal Area and select the local bank transfer option. You’ll then need to enter the amount you wish to deposit.

- Bank Details and Processing: After confirming the deposit amount, Exness will provide you with the bank details needed to complete the transfer. You’ll then need to log into your online banking platform or visit your bank to initiate the transfer using the provided details.

- Confirmation and Timing: Once you’ve completed the transfer, the funds will typically appear in your trading account within a few hours to a few business days, depending on the bank’s processing times.

Local Bank Transfers for Withdrawals

- Requesting a Withdrawal: In your Exness Personal Area, select the withdrawal option and choose local bank transfer. Enter the amount you wish to withdraw and provide any required banking information.

- Processing Time: Withdrawals via local bank transfers can take a few business days to be processed and appear in your bank account. The exact timing can vary based on your bank’s policies and operational hours.

- Fees and Limits: Be aware of any potential fees charged by your bank for receiving funds. While Exness typically does not charge fees for deposits or withdrawals, it’s crucial to verify if your bank imposes any additional charges.

- Security: Exness employs robust security measures to protect all financial transactions. Ensure that your banking details are kept up to date in your Personal Area to avoid any delays or issues with your transfers.

Advantages for South African Traders

- Currency Compatibility: Using local bank transfers allows South African traders to transact in ZAR, potentially reducing currency conversion fees and simplifying financial management.

- Convenience and Familiarity: Dealing with local banks means traders can use familiar banking platforms and processes, enhancing the overall convenience and efficiency of financial transactions.

- Regulatory Compliance: Local bank transfers comply with South African financial regulations, ensuring that your trading activities remain within the legal framework.

Currency Conversion and Fees Exness

Exness provides a transparent approach to currency conversion and fees, ensuring that traders are well-informed about any potential costs associated with their trading activities. Understanding how currency conversion and associated fees work is crucial for traders to manage their finances effectively and make informed trading decisions. Here’s an overview of currency conversion and fees at Exness:

Currency Conversion

- Trading Account Currencies: Exness allows traders to open accounts in various currencies. If a trader deposits or withdraws funds in a currency different from their account currency, a conversion will occur.

- Conversion Rates: Exness provides competitive exchange rates for currency conversion. These rates are determined by the current market conditions and may fluctuate based on global financial markets.

- Transparency: Before finalizing a transaction that requires currency conversion, Exness typically displays the estimated conversion rate and the amount in the account’s base currency, ensuring traders are aware of the exact figures.

- Automatic Conversion: When traders deposit funds in a currency different from their trading account currency, Exness automatically converts the funds at the prevailing market rate.

Fees

- Deposit Fees: Exness prides itself on not charging any deposit fees. Traders can fund their accounts without worrying about additional charges from the broker’s side.

- Withdrawal Fees: Similarly, Exness usually does not impose charges on withdrawals. However, it’s important for traders to check if their selected payment method or financial institution imposes any fees.

- Inactivity Fees: As of the last update, Exness does not charge inactivity fees, which is beneficial for traders who may not trade regularly.

- Overnight Fees/Swaps: Traders should be aware of overnight fees or swap rates if they hold positions open overnight. These rates depend on the specific instrument and market conditions.

- Third-Party Fees: While Exness minimizes fees on its part, traders should be mindful of potential charges from third-party payment processors or banks, especially during deposits or withdrawals.

For South African Traders

- Local Currency Accounts: South African traders can benefit from having an account in ZAR to avoid currency conversion fees for deposits and withdrawals in their local currency.

- Awareness of Fees: It’s advisable for South African traders to stay informed about any fees their local banks may impose, particularly for international transfers or currency conversion.

Exness Safety and Security

Exness is committed to providing a safe and secure trading environment for its clients, employing a range of measures to protect user data and funds. The company’s approach to safety and security is comprehensive, covering regulatory compliance, data encryption, account security, and financial integrity. Here’s an overview of how Exness ensures safety and security for its traders:

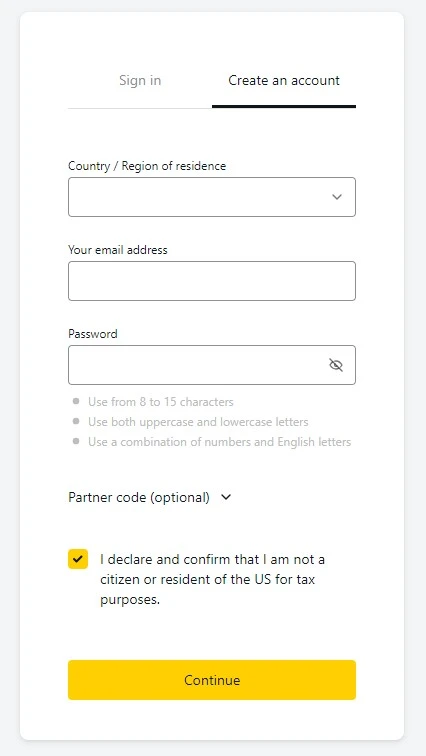

Step-by-Step Account Registration

- Visit the Exness Website: Start by navigating to the Exness official website, where you’ll find the option to sign up or register for a new account.

- Sign Up: Click on the “Register” or “Open an Account” button. You’ll be prompted to enter basic information such as your email address and to set a password. South African traders need to ensure that their details are accurate and up-to-date.

- Account Verification: After signing up, you’ll need to verify your account to comply with financial regulations. This verification process is crucial for ensuring the security of your transactions and adherence to anti-money laundering (AML) policies.

- Upload Required Documents: You will be required to upload identification documents. For South African traders, this typically includes a valid ID (such as a passport or national ID card) and proof of residence (like a recent utility bill or bank statement).

- Wait for Verification Approval: Once you’ve submitted your documents, Exness will review them for verification. This process usually takes a short while, and you’ll be notified upon completion.

- Complete the Economic Profile: Exness requires you to fill out an economic profile, which includes questions about your employment status, financial assets, and trading experience. This is to ensure that the services provided align with your trading expertise and financial situation.

Verification Process

- Identity Verification: Confirm your identity by providing a clear, valid copy of your government-issued identification.

- Proof of Residence: Submit a recent utility bill or bank statement (not older than three months) that shows your name and physical address in South Africa.

- Additional Verification: In some cases, Exness might request additional documents to complete the verification process, ensuring compliance with international financial regulations.

After Registration

- Once your account is verified, you can explore the various trading platforms offered by Exness, such as MetaTrader 4 or MetaTrader 5, and customize your trading experience according to your preferences.

- You’ll also have access to Exness’s educational resources, customer support, and trading tools to assist you in making informed trading decisions.

By following these steps, South African traders can efficiently register and set up their Exness trading account, paving the way for a comprehensive trading experience that emphasizes security, compliance, and user-friendliness.

Customer Support of Exness

Exness has a robust customer support system for its global clients, including those in South Africa, with the following features:

- Multilingual Support: Customer service in multiple languages for a diverse client base.

- 24/7 Availability: Round-the-clock customer support to assist traders at any time.

- Various Communication Channels: Live chat, email, phone support, and callback service.

- Educational Resources and FAQ: Extensive FAQ section and educational materials.

- Personalized Assistance: Dedicated account managers for certain account types.

- Technical Support: Assistance with trading platform issues.

- Security and Account Assistance: Help with account-related queries and security.

Conclusion

Exness offers a comprehensive and user-friendly trading experience for clients, particularly highlighting its robust services for traders in South Africa. The platform’s diverse array of deposit and withdrawal methods, including local bank transfers, caters to the convenience and preferences of South African traders. Moreover, the transparent approach to currency conversion and fees ensures that traders face no hidden charges, fostering a trustworthy trading environment.

Exness’s commitment to safety and security is evident in its adherence to regulatory standards, implementation of advanced security protocols, and provision of educational resources to empower traders. The broker’s dedication to customer satisfaction is further underscored by its accessible, multilingual 24/7 customer support, ready to assist with a wide range of inquiries and issues.

For traders in South Africa and globally, Exness presents a reliable and efficient platform, supporting their trading journey with robust tools, resources, and support. Whether a novice or an experienced trader, Exness’s infrastructure is designed to facilitate a seamless and productive trading experience, underpinned by a strong ethos of transparency, security, and customer-centric service.

What deposit methods are available at Exness?

Exness offers a variety of deposit methods including local bank transfers, credit/debit cards, e-wallets like Skrill and Neteller, and cryptocurrencies. The availability of these methods can vary depending on your country of residence.