In addition to these primary account types, Exness also provides specialized accounts such as the Zero and Raw Spread accounts, designed for traders looking for ultra-low spreads and faster execution speeds. The Zero Account, for instance, offers near-zero spreads on major currency pairs, making it ideal for scalpers and high-volume traders. Meanwhile, the Raw Spread Account provides direct market access with some of the lowest spreads available, appealing to traders who prefer a commission-based pricing structure. All Exness accounts come with the benefit of negative balance protection, ensuring that traders do not lose more than they have deposited, and support a range of deposit and withdrawal methods for added convenience.

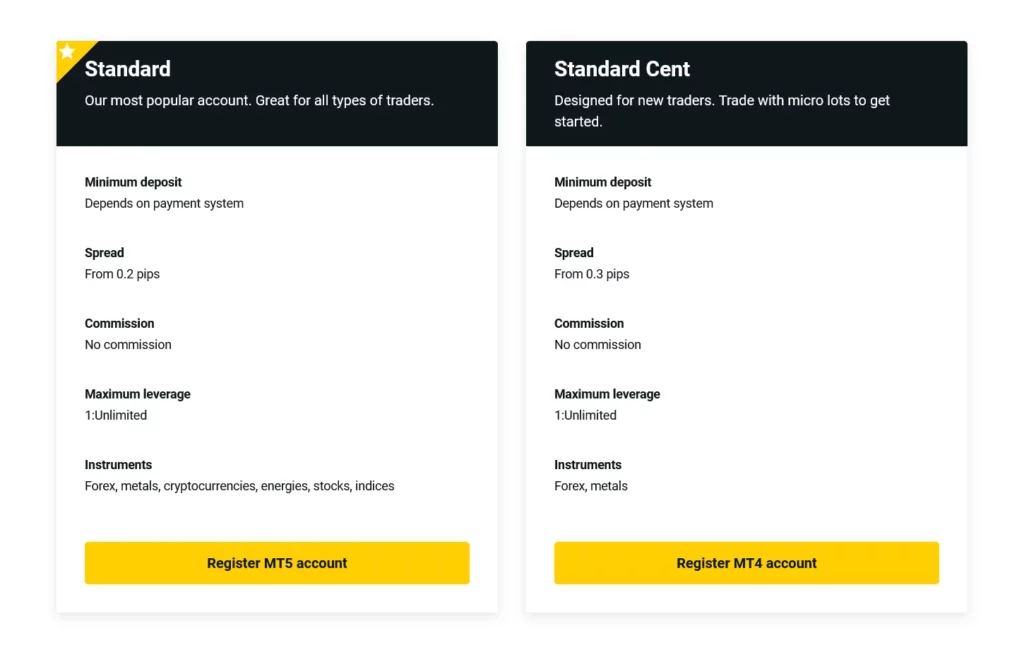

Exness Standard Accounts

Exness provides various Standard Account options that cater to different types of traders. Below is a detailed overview of the key features associated with Exness Standard Accounts, presented in table format for clarity:

Exness Standard Account Features:

| Feature | Description |

| Account Type | Standard Account |

| Minimum Deposit | No minimum deposit requirement, offering flexibility for traders of all levels. |

| Spread | From 0.3 pips, providing competitive trading conditions. |

| Leverage | Up to 1:2000, allowing traders significant flexibility in their trading strategies. |

| Commission | No commission on trades, making it cost-effective especially for beginners. |

| Financial Instruments | Access to forex, metals, cryptocurrencies, energies, and indices. |

| Execution Type | Instant execution, ensuring fast and reliable trade placements. |

| Platform | Available on MetaTrader 4 and MetaTrader 5 platforms, accommodating different trader preferences. |

| Minimum Lot Size | 0.01, offering flexibility in position sizing for risk management. |

| Margin Call/Stop Out | 60%/0%, helping traders manage their risk effectively. |

| Negative Balance Protection | Yes, ensuring traders do not lose more than their deposited funds. |

Exness Standard Cent Account

The Exness Standard Cent Account is an ideal choice for traders who are new to the forex market or those who wish to trade with lower risks. This account type allows traders to deal in smaller trade sizes and manage their investments more effectively, especially when experimenting with new strategies or learning the market dynamics. Below is a detailed overview of the Exness Standard Cent Account features presented in a tabular format:

Exness Standard Cent Account Features:

| Feature | Description |

| Account Type | Standard Cent Account |

| Minimum Deposit | No specific minimum deposit, allowing traders to start with small amounts of money. |

| Spread | From 0.3 pips, providing competitive spreads for cent account holders. |

| Leverage | Up to 1:2000, offering substantial leverage options for various trading strategies. |

| Commission | No commission, making trading more accessible by reducing the cost per trade. |

| Financial Instruments | Access to a broad range of markets including forex, metals, and more. |

| Execution Type | Instant execution, ensuring quick and reliable trade executions. |

| Platform | Available on both MetaTrader 4 and MetaTrader 5, catering to different platform preferences. |

| Minimum Lot Size | 0.01 cent lots, equating to 1,000 units of base currency, allowing for finer risk management. |

| Margin Call/Stop Out | 60%/0%, providing a safety buffer to help manage trading risks effectively. |

| Negative Balance Protection | Yes, ensuring traders cannot lose more than their account balance. |

The Exness Standard Cent Account is particularly beneficial for novice traders or those looking to trade smaller volumes without significant financial exposure. It offers a practical and low-risk platform for traders to gain experience, test strategies, and understand market movements with minimal investment.

Exness ECN Account

The Exness ECN Account is designed for traders who prefer direct access to interbank market rates, offering a more transparent trading environment where they can benefit from real-time order execution. This account type is particularly favored by professional traders and those who prefer scalping as their trading strategy due to its low spreads and fast execution speeds. Here’s an in-depth look at the Exness ECN Account features, presented in a tabular format:

Exness ECN Account Features:

| Feature | Description |

| Account Type | ECN (Electronic Communication Network) Account |

| Minimum Deposit | $200, catering to traders who are ready to trade with a higher capital investment. |

| Spread | From 0.0 pips, offering highly competitive rates directly from the interbank market. |

| Commission | $25 per million traded, providing a clear, transparent fee structure. |

| Leverage | Up to 1:200, allowing traders flexibility in their trading strategies with higher risk management. |

| Execution Type | Market execution, ensuring the best possible prices with immediate execution. |

| Trading Instruments | Access to forex, metals, cryptocurrencies, and more, providing a broad trading portfolio. |

| Platform | Available on MetaTrader 4 and MetaTrader 5, supporting all the functionalities of these platforms. |

| Minimum Lot Size | 0.01, offering precise control over trade sizes for better risk management. |

| Margin Call/Stop Out | 100%/50%, designed to protect traders from negative balance risks. |

| Negative Balance Protection | Yes, securing traders from losing more than their deposited funds. |

The ECN Account by Exness is tailored for those who demand swift execution and access to deep liquidity pools. This account type is especially suitable for experienced traders who require a direct connection to the market and wish to utilize strategies that need quick and accurate order fulfillment.

Exness Islamic Account

Exness offers Islamic accounts, also known as swap-free accounts, which comply with Sharia law by not charging or crediting overnight interest. These accounts are suitable for traders who wish to adhere to Islamic finance principles while engaging in forex trading. The Islamic accounts at Exness provide the same trading conditions as their conventional counterparts but without the swap fees that contradict Islamic finance rules.

Exness Islamic Standard Account Features:

| Feature | Description |

| Account Type | Islamic Standard Account |

| Minimum Deposit | No minimum deposit requirement, making it accessible for traders of all levels. |

| Spread | From 0.3 pips, offering competitive trading conditions without swap charges. |

| Leverage | Up to 1:2000, providing flexibility in trading strategies and risk management. |

| Commission | No commission on trades, aligning with Islamic finance principles. |

| Financial Instruments | Access to forex, metals, cryptocurrencies, energies, and indices without swap fees. |

| Execution Type | Instant execution, ensuring timely and efficient trade operations. |

| Platform | Available on MetaTrader 4 and MetaTrader 5, catering to various trading preferences. |

| Minimum Lot Size | 0.01, allowing precise control over trade sizes and risk management. |

| Margin Call/Stop Out | 60%/0%, helping traders manage their risks effectively without compromising their beliefs. |

| Negative Balance Protection | Yes, providing an additional safety net for traders. |

Exness Islamic Professional Account Features:

| Feature | Description |

| Account Type | Islamic Professional Account |

| Minimum Deposit | Higher minimum deposit than the standard account, targeting more experienced traders. |

| Spread | From 0.0 pips on certain instruments, offering direct market access without swap fees. |

| Leverage | Up to 1:2000, allowing seasoned traders to employ advanced trading strategies. |

| Commission | Commissions may apply depending on the account type, detailed transparently to the user. |

| Financial Instruments | Includes a wide range of instruments, available for trade in accordance with Islamic principles. |

| Execution Type | Market execution for real-time trading without swaps. |

| Platform | Supports both MetaTrader 4 and MetaTrader 5 platforms, providing versatility in trading. |

| Minimum Lot Size | 0.01, offering flexibility in managing trades and investment sizes. |

| Margin Call/Stop Out | 100%/50%, ensuring traders can manage positions within safe limits without incurring interest. |

| Negative Balance Protection | Yes, safeguarding traders from exceeding their account balance. |

These Islamic accounts ensure that traders can participate in the forex market without compromising their religious beliefs, providing a swap-free environment that still offers competitive trading conditions.

Exness Demo Account

Exness offers Demo Accounts for traders who wish to practice their trading strategies in a risk-free environment. These accounts simulate real trading conditions, allowing traders to familiarize themselves with the platform and market dynamics without using real money. Here’s an overview of the Exness Demo Account features presented in a structured table format:

Exness Demo Account Features:

| Feature | Description |

| Account Type | Demo Account |

| Minimum Deposit | No deposit required, as the account uses virtual funds for trading practice. |

| Spread | Reflects real trading conditions, providing a realistic trading experience. |

| Leverage | Adjustable, allowing users to practice with various leverage settings. |

| Commission | No real commissions, mirroring the conditions of a corresponding real account type. |

| Financial Instruments | Access to a wide range of instruments, including forex, metals, cryptocurrencies, and more. |

| Execution Type | Depends on the selected real account type simulation, offering both instant and market execution. |

| Platform | Available on MetaTrader 4 and MetaTrader 5, giving users the chance to test both platforms. |

| Minimum Lot Size | 0.01, enabling users to practice micro-lot trading. |

| Margin Call/Stop Out | Simulated based on the chosen leverage and platform settings to offer realistic practice. |

| Negative Balance Protection | Simulated to reflect the protection available in real accounts. |

Using an Exness Demo Account is an excellent way for both beginners and experienced traders to refine their trading strategies, test new ideas, or get accustomed to the platform’s features without any financial risk. It’s an invaluable tool for educational purposes and for making informed decisions about transitioning to live trading.

Choosing the Right Account Type

Choosing the right account type is crucial for your trading success as it should align with your trading style, experience level, and financial goals. Here’s a structured approach to help you select the appropriate account type.

Assess Your Experience Level:

- Beginner: If you’re new to forex trading, consider accounts like the Exness Standard or Standard Cent accounts. These accounts typically offer user-friendly platforms, educational resources, and the flexibility to trade small amounts.

- Intermediate/Advanced: More experienced traders might prefer accounts that offer more complex tools and features, like the Exness Professional or ECN accounts, which provide tighter spreads and faster execution.

Consider Your Investment Size:

- Small Investment: A Standard Cent account is ideal if you want to trade with smaller amounts. It allows you to trade smaller lot sizes and manage risk more effectively without a significant initial deposit.

- Larger Investment: If you’re ready to trade with more substantial amounts, consider the Standard or Professional accounts, which can handle larger volumes and provide more leverage options.

Understand Trading Costs:

- Spread-Sensitive: If you prefer paying no commissions and can work with slightly wider spreads, a Standard account might be suitable.

- Commission-Sensitive: If you prefer tighter spreads and are okay with paying a commission, an ECN account could be more appropriate.

Trading Strategy Compatibility:

- Scalping/Day Trading: You might benefit from an ECN or Professional account, which offers lower latency and faster execution speeds.

- Swing/Position Trading: A Standard account might be sufficient if you hold positions for longer periods and are less concerned with execution speed.

Leverage Needs:

Different accounts offer different leverage levels. Assess how much leverage you require based on your risk tolerance and trading strategy. Remember, higher leverage increases both potential profits and potential losses.

Swap Considerations:

If you adhere to Islamic finance principles, opt for an Islamic account to ensure your trading practices are swap-free.

Demo Account:

Before committing to a specific account type, try a Demo Account to simulate trading without financial risk. It can help you get a feel for the platform and its features, ensuring it meets your needs.

Customer Support and Education:

Especially for new traders, having access to robust customer support and educational resources can be a deciding factor in choosing an account.

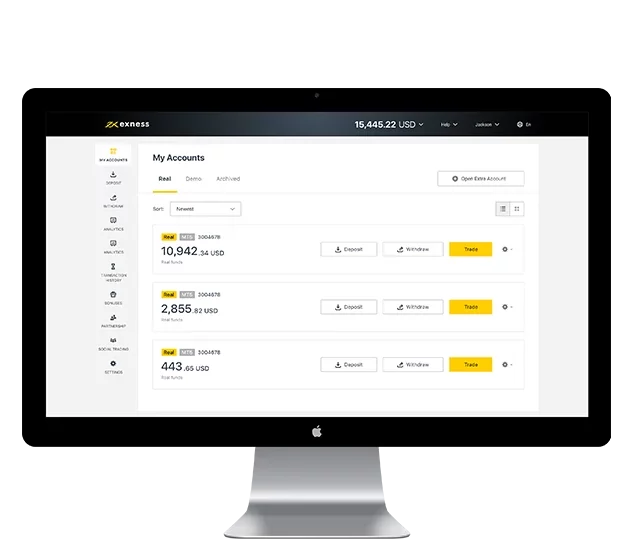

Opening an Exness Account in South Africa

Opening an Exness account in South Africa is a straightforward process that aligns with the broker’s standard procedure for account registration. Here’s a step-by-step guide to help you set up your Exness account if you’re residing in South Africa:

- Visit the Exness Website: Start by navigating to the Exness website. Make sure you access the version of the site that serves South African residents, ensuring compliance with local regulations.

- Sign Up: Click on the “Open an Account” or “Register” button on the homepage.

- Account Verification: To comply with financial regulations, you’ll need to verify your identity and residence. This typically involves uploading a government-issued ID (like a passport or driver’s license) and a proof of residence document (such as a utility bill or bank statement dated within the last three months).

- Choosing Your Account Type: Select the account type that best fits your trading needs. As discussed, Exness offers various account types like Standard, Cent, ECN, and Professional accounts. Each account type has different features and requirements, so choose the one that aligns with your trading style and experience.

- Making a Deposit: Once your account is set up and verified, you can fund it using one of the payment methods available in South Africa. Exness typically offers several funding options, including bank transfers, credit/debit cards, and e-wallets. Check for any local payment methods that might be specifically available for South African traders.

- Platform Access: After funding, you’ll gain access to the trading platform. Exness provides platforms like MetaTrader 4 and MetaTrader 5. Download and install the platform of your choice, then log in using the credentials provided by Exness.

- Demo Account: If you’re new to trading or want to practice without financial risk, consider starting with a demo account. This will allow you to familiarize yourself with the platform and trading conditions without using real money.

- Educational Resources: Take advantage of Exness’s educational resources, which can be particularly beneficial if you’re a beginner. These may include tutorials, webinars, and articles that can help you improve your trading knowledge and skills.

- Customer Support: If you have any questions or need assistance during the account setup process, reach out to Exness’s customer support. They typically offer support through various channels, including live chat, email, and phone. Provide your email address and set a password, or you can often sign up using an existing Google or Facebook account.

By following these steps, you can set up your Exness account in South Africa and start trading. Always remember to trade responsibly, considering the risks involved in forex trading, and ensure that you understand the features and requirements of your chosen account type.

Comparing Professional Accounts with Standard Accounts

When comparing Professional Accounts to Standard Accounts at Exness, there are several key differences that cater to the distinct needs of different types of traders. Here’s a comparative analysis highlighting the main differences:

Spreads and Commissions:

- Professional Accounts (Raw Spread, Zero, Pro): These accounts typically offer lower spreads. The Raw Spread and Zero accounts might have spreads as low as 0.0 pips but include a commission on trades. The Pro account, while having slightly higher spreads, usually does not charge a commission.

- Standard Accounts: These accounts offer higher spreads but without the commission charges, making them more suitable for casual or beginner traders who might not trade as frequently or in large volumes.

Minimum Deposit:

- Professional Accounts: These accounts generally require a higher minimum deposit, reflecting their suitability for more serious traders who are likely to trade with larger amounts of capital.

- Standard Accounts: They have a lower minimum deposit requirement, making them more accessible to a broader range of traders, especially beginners or those with less capital to commit.

Leverage:

- Both Professional and Standard accounts at Exness offer high leverage options, but the maximum available leverage might vary depending on the account type and the trader’s balance and experience.

Platform Access:

- Standard Accounts: These accounts offer higher spreads but without the commission charges, making them more suitable for casual or beginner traders who might not trade as frequently or in large volumes.

Risk Management Features:

- Negative balance protection is available for both account types, but Professional Accounts might offer more sophisticated risk management tools and options, reflecting the higher risk profile of their trading activities.

Trading Instruments:

- Professional Accounts: Offer a wider range of trading instruments, potentially including more exotic pairs and CFDs, catering to the needs of advanced traders looking for diversification.

- Standard Accounts: While still providing a broad selection, the range of instruments might be more tailored to mainstream or popular choices, suitable for general trading.

Customer Support and Resources:

- Professional Accounts: Traders often receive more personalized customer support and access to advanced trading tools and resources.

- Standard Accounts: Standard support is available, which is comprehensive but may not include the advanced advisory or analytical tools offered to professional account holders.

Choosing between a Professional and a Standard account should be based on your trading experience, capital, and strategy. Professional accounts are tailored for experienced traders who can utilize the advanced features to their advantage, while Standard accounts are better suited for new or casual traders focusing on learning and gradual capital growth. For specific details and the latest offerings, it’s advisable to consult Exness’s website directly.

What is the minimum deposit required to open an Exness account?

Exness offers accounts with no minimum deposit for Standard and Standard Cent accounts, but the ECN and Professional accounts require a minimum deposit, typically starting from $200.